I recently posted on

differences in human development across states as measured by the

American Human Development Index. There is also a

Human Development Index (HDI) used by the United Nations to measure human well-being around the world. It also focuses on three measures of well-being: longevity, education and standard of living. It teaches many of the same lessons that I highlighted in my post about human development in the US. The

2013 annual report on human development was released by the UN in March.

The

US fares well overall in the HDI, behind only Norway and Australia. When adjusted for inequality, however, the

US drops to an embarrassing 16th. Adjusting for inequality is sensible as the whole point of measuring human development is to determine how a society is faring, not just to measure the lives of a few very high income citizens. Some in the US live very well; on the other hand,

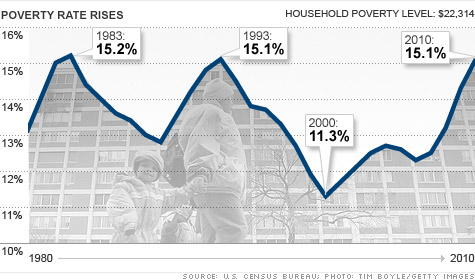

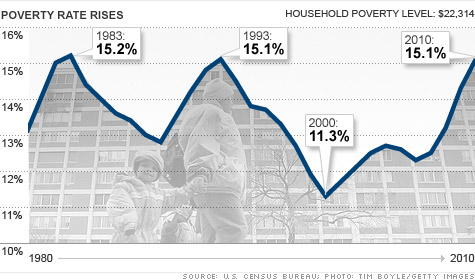

about 80 percent of Americans will have a brush with poverty at some point in their lives. By any reasonable reckoning that suggests that many if not most Americans are exposed to a high degree of economic insecurity. And, as depicted in the chart to the right,

recently poverty in the US equaled a 27 year high. Worse,

childhood poverty in the US is higher than in all other developed nations except Romania--at

about 23 percent. This is both morally reprehensible and economically backwards. Such a high level of poverty (particularly among children) is inconsistent with a healthy society. No nation can reach its economic potential if a high percentage of its people are in poverty because impoverished people struggle just to survive rather than thriving economically or investing in enhanced productive capability.

The fundamental difference between the US and the rest of the developed world in terms of the HDI and poverty is tax policy. Every nation that scores higher than the US in both the HDI as well as the inequality adjusted HDI taxes their economy more than the US in terms of total tax revenues as a ratio of GDP. In fact, among developed nations only Mexico and Chile tax less. Some nations such as Denmark and Sweden tax at nearly twice the rate as the US. The average developed nation taxes more than ten percent more of its GDP than the US. According to

Citizens for Tax Justice, relying upon OECD data, the US historically taxed its economy at more internationally comparable rates. In 2000, the US was just four percentage points below average--

and actually rang up a significant federal surplus. In 1965, the US taxed at the same rate as other OECD nations.

Sweden has a

childhood poverty rate of about 7.5 percent, and Denmark's childhood poverty rate is even lower at about 7 percent. Both Sweden and Denmark enjoy a

higher life expectancy than the US. Yet, despite higher levels of taxation and achieving superior social outcomes both nations also generate higher per capita GDP than the US

according to the World Bank. In fact, of all the nations in the graphic to the right that tax more than the US no less than seven have higher GDP per capita than the US (sometimes substantially higher). Six of those seven nations also enjoy higher inequality adjusted HDI scores than the US: Sweden, Switzerland, Norway, Australia, Canada and Denmark. All six have higher life expectancy--

as much as four years higher. So, national economic success is not compromised by taxes that are used to empower people by lifting them out of poverty or enhancing their health outcomes. In fact, people seem to live longer and better in higher taxation nations.

The problem with the US is that we have chronically deprived the government of the resources needed to empower our people. The problem is not limited to just taxes but also where we spend our government resources. For example,

none of the nations discussed above bears the burden of sending more than $700 billion on defense. Indeed, the

US spends nearly as much on defense as the rest of the developed world combined. Further, total federal

tax revenues as a percentage of GDP now stand at a 50 year low.

Thus, the US government simply lacks the tax revenues to invest in its people. Take the GI Bill as an example: The original GI Bill put in place after World War II generated

economic benefits of up to $12.50 for every dollar the government spent. College degrees conferred in the US soared from

217,000 in 1940 to 499,000 in 1950. This was human development on a grand scale. Today, the GI Bill grants benefits that are a shadow of the original bill. As two noted scholars report: "

Despite the mammoth scope and potential cost of the Post 9/11 G.I. Bill, the new bill is not nearly as lavish as the original GI Bill of 1944."

Across educational outcomes the US is fast sinking to the bottom of the developed world. In tertiary education graduation the US fell from

fourth to 14th among developed nations in just 17 years and is now below the OECD average. In the

latest international assessment of primary education outcomes the US scored dead last among 17 nations. In the most recent PISA scores the

US 15 year olds ranked 31st out of 32 nations in math scores and 23rd out of 32 in science as shown in the chart at right. This should come as no surprise as impoverished children simply

cannot reach full educational capacity.

Essentially, we have reached precisely the point of my earlier blog on human development across states: "

conservative economic ideology of less government and more laissez faire policies delivers inferior outputs for people in terms of objective measures of well-being.

Sound regulation, investment in human and other infrastructure, and economic empowerment work--and that requires a robust government." But, looking at the facts trans-nationally, one cannot help but to find my conclusion from Law Capitalism correct: "

The U.S. under-invests in education and fails to use its resources effectively. Given the centrality of ideas to economic growth, the U.S. abdicated economic leadership over the past twelve to fifteen years."

Of course, it really does not matter to governing elites whether the US can compete globally or whether the US slides slowly into third world status. They

rigged college admissions so their kids win no matter what. And, their kids will get the finest education money can buy at super-elite private schools: "

Exeter devotes an average of $63,500 annually to house and educate each of its 1,000 students." If they can convince 51 percent of voters that

laissez faire produces the best outcomes against all evidence then (literally) more power to them.